Wall Street Is Betting on Amazon Stock Ahead of Q2 Earnings. Should You?

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

Amazon (AMZN) is set to report its second-quarter earnings for 2025 on Thursday, July 31. Notably, AMZN stock has staged an impressive comeback ahead of earnings, growing 22.5% over the past three months. Yet despite this recent surge, Amazon shares have only gained 5.6% since the beginning of the year, indicating that not everything has gone smoothly for the technology giant so far in 2025.

While Amazon continues to show steady growth across its business segments, its all-important cloud division, Amazon Web Services (AWS), grew at a slower pace than expected. Moreover, broader concerns about the economy, inflation, and tariffs have weighed on Amazon stock.

Even so, optimism remains high among Wall Street analysts. Many see Amazon as a long-term winner, especially as AWS’s growth rate could reaccelerate and the company continues to profitably grow its e-commerce and advertising businesses.

While analysts are bullish about AMZN stock ahead of earnings, the upcoming Q2 earnings report will determine the future trajectory of the stock.

Amazon to Deliver Solid Growth in Q2

Amazon is on track to deliver a strong second-quarter performance. Management is projecting net sales between $159 billion and $164 billion, marking a year-over-year increase of 7% to 11%. The tech company’s core retail operations remain solid, as its value pricing strategy, an expansive product selection, and fast delivery continue to appeal to consumers despite ongoing macroeconomic uncertainty and trade-related headwinds.

The ongoing strength in Amazon’s retail business is led by its solid delivery infrastructure. The company’s investment in speeding up delivery has paid off, reducing delivery time for Prime members and driving customer loyalty. The company has also optimized its fulfillment network and last-mile logistics, achieving a reduction in cost per unit for the second consecutive year. These efficiencies, bolstered by Amazon’s ongoing investments in automation and robotics, position the company well to maintain margins even as it scales.

AWS continues to be the key contributor of revenue and earnings for Amazon. With an annualized revenue run rate of $117 billion and a growing portfolio of enterprise clients, AWS is increasingly central to Amazon’s long-term growth narrative. Cloud adoption remains robust, driven by ongoing digital transformation and the rising demand for generative AI capabilities. AWS is well-positioned to serve both types of workloads, giving it a competitive edge. Although AWS growth moderated slightly in the first quarter, this slowdown appears cyclical, tied to cautious enterprise spending in an uncertain economic climate. Importantly, the AWS backlog grew 20% year-over-year to $189 billion in Q1, providing a strong pipeline of future growth.

Another area of notable momentum is Amazon’s advertising segment, which saw revenues jump 19% year-over-year in Q1. As brands increasingly prioritize digital platforms that offer end-to-end customer engagement, Amazon’s full-funnel advertising solutions are becoming a go-to option. This segment is quickly evolving into a significant profit center, complementing the company’s existing retail and cloud strengths.

As Amazon continues to diversify its revenue and drive efficiency across its operations, it looks well-positioned to deliver solid earnings heading into Q2. Analysts expect the company to report earnings of $1.33 per share, reflecting an 8.1% year-over-year increase. Notably, Amazon has exceeded Wall Street’s earnings expectations for four straight quarters, including a 17.8% earnings surprise last quarter. This solid bottom-line performance adds a layer of optimism ahead of Q2 earnings.

Is Amazon Stock a Buy Now?

Amazon stock made a strong comeback over the past three months. Moreover, several factors suggest the rally will sustain. The company continues to benefit from steady e-commerce demand. Further, its focus on streamlining logistics and improving efficiency will boost profitability, positioning the company for continued growth.

Amazon’s advertising segment is growing at a healthy pace and making a meaningful contribution to the bottom line. Meanwhile, AWS continues to expand, and a robust backlog signals strong demand from enterprise customers.

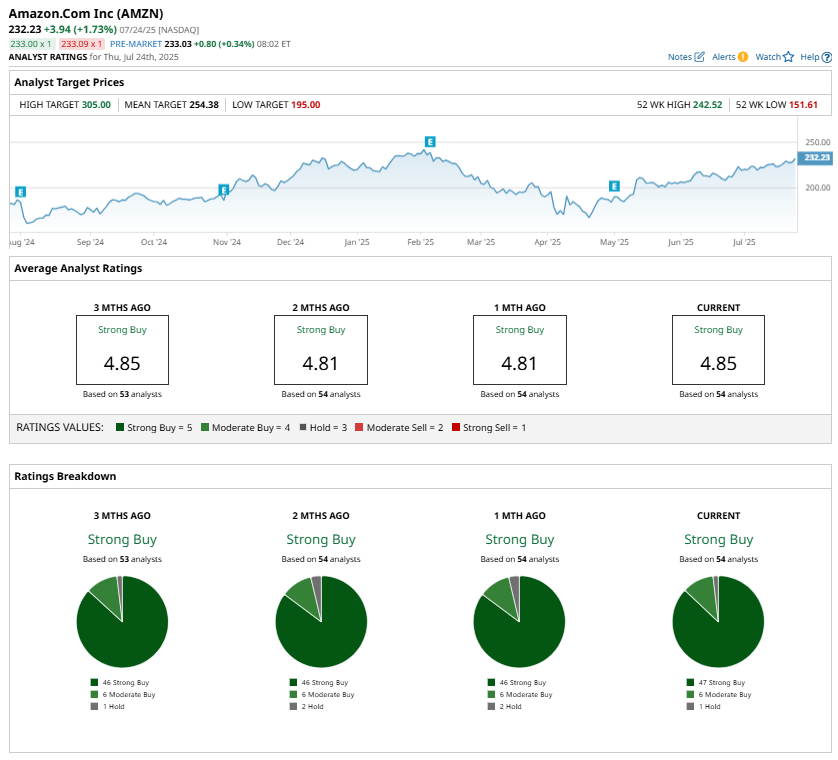

Analysts remain bullish about Amazon stock and maintain a “Strong Buy” consensus rating ahead of Q2 earnings.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.